Rigorous testing of banking applications ensures the accuracy and security of financial transactions and customer information. It also helps protect customer trust and maintain the integrity of financial systems.

Overview

What is Banking Domain Testing?

Banking domain testing involves evaluating the functionality, security, and performance of banking applications to ensure they meet industry standards, regulatory requirements, and user expectations.

Importance of Banking Domain Testing

- Protects sensitive financial data from breaches and unauthorized access.

- Identifies and fixes security flaws that could lead to fraud.

- Ensures compliance with regulations like KYC, AML, and other financial standards.

- Minimizes downtime to ensure the app is always available for users.

Types of Banking Domain Testing

- Functional Testing: Verify core features such as transaction processing, balance updates, and account management.

- Security Testing: Identify vulnerabilities, ensure data encryption, and check compliance with security protocols.

- Performance Testing: Assess the app’s ability to handle high transaction volumes without delays or interruptions.

- Cross-Browser and Device Testing: Ensure that the app looks and works consistently across different browsers, devices, and screen sizes.

- Usability Testing: Evaluate the user interface for ease of navigation and ensure efficient transaction completion.

This article delves into the key aspects of banking domain testing and serves as a guide for QA professionals responsible for testing banking applications.

What is Banking Domain Testing?

Banking domain testing involves assessing the functionality, performance, security, and user experience of banking applications to ensure they meet customer expectations and regulatory requirements.

As more customers shift to digital platforms for tasks like money transfers and balance checks, testing becomes crucial to ensure smooth operations, minimize downtime, and protect sensitive financial data.

This process also focuses on validating compliance with industry regulations and preventing vulnerabilities that could lead to fraud or data breaches, ensuring secure and user-friendly banking applications.

Characteristics of Banking Apps

Banking applications must meet high standards for security, reliability, and usability. Essential characteristics include:

- Multi-Session Support: Allow multiple users to access accounts simultaneously without conflicts.

- Seamless Integration: Connect efficiently with external systems, including trading platforms, payment gateways, and financial tools.

- Complex Workflow Handling: Manage sophisticated banking processes like loans, fund transfers, and approvals with accuracy.

- Secure Transactions: Ensure all transactions are encrypted, authenticated, and protected against fraud.

- Transaction Tracking: Maintain accurate, real-time records of daily user and system activities.

- Effective Issue Resolution: Provide mechanisms to detect, report, and resolve customer issues promptly.

- Scalable Storage: Handle large volumes of data, including account histories, reports, and documents.

- Disaster Recovery: Implement robust backup and recovery processes to minimize downtime and data loss.

- Cross-Platform Accessibility: Support multiple operating systems, including Windows, macOS, Linux, and Unix, for both web and mobile users.

- User Support and Experience: Offer intuitive interfaces and support features to assist users in managing their finances efficiently.

Importance of Testing Banking Apps

Insufficient testing of banking domain applications will not just inconvenience users with sub-par functions and features. It can also directly damage your business and reputation by allowing malicious parties to acquire customer data or access customer funds in the worst-case scenario.

Below are the key reasons why it is important to test banking applications:

- Protects Sensitive Data: Ensures that personal and financial data is secure from breaches, preventing potential loss or misuse of customer information.

- Prevents Financial Losses: Insufficient testing can lead to vulnerabilities that allow fraudsters to steal funds or conduct fraudulent activities, directly impacting a bank’s bottom line.

- Maintains Reputation: Security flaws and poor app performance can lead to loss of customer trust and reputational damage.

- Ensures Compliance: Banking applications must comply with strict regulations and security standards to avoid legal issues and penalties.

- Improves User Experience: Proper testing guarantees smooth and reliable functionality, boosting customer satisfaction and retention.

- Reduces Risk of Cyberattacks: Comprehensive testing helps identify and fix vulnerabilities, reducing the risk of cyberattacks targeting banking apps.

Banking apps must be extensively, meticulously, and painstakingly tested on real mobile devices rather than emulators/simulators to prevent such disasters.

Major features of banking applications to test

Below are the major features of banking applications that need to be tested:

1. Authentication gateways: Given that banking apps deal almost entirely with sensitive data (personal identifiers, credit, and debit card numbers, income details, etc.), they need to protect user access at all costs. Fortifying secure user access is legally binding under the GDPR and Payment Service Directive 2 (PSD2). Generally, adequately secure authentication requires the following

- Login credentials or a PIN

- Physical features (fingerprint, sometimes retinal scans)

- Security questions/phases/images to be validated (CAPTCHA, for example)

Also Read: How to handle Captcha in Automation Testing

2. Account management: The account management feature tracks, catalogs, and displays all relevant information to users – account balance, money transfer services, etc. It also lets them get necessary tasks done quickly and with zero errors.

Again, since all the information revolves around actual money, mistakes are intolerable in these databases. Every user should have a separate database ID for themselves. They should be able to see real-time data. Anytime a transaction fails, money should bounce back to the originating account as quickly as possible. Inactive accounts must be disabled after a certain period. In fact, the app itself should automatically log out if it has been inactive for a particular duration.

3. Payment support: Banking apps must support payment options outside the usual bank-to-bank transaction. This could be QA-based payment support, integrations with other apps (delivery apps, e-Commerce apps, food apps, booking services), and the like.

4. Customer support: Customers should be able to access assistance anytime they want. Most banks assign some kind of relationship manager for customers to call when they need help, but hiring workers to be available 24/7 would be expensive and a managerial nightmare.

Of course, a human presence is always mandatory. But intelligent chatbots have proved to be a favorable alternative. Bots don’t get tired, are active around the clock, and don’t make human errors. Of course, this is considered that the bot has been intelligently designed to handle a large number of common customer questions, complaints, and requirements

Bear in mind that, depending on the app and bank behind it, other features may be added on. However, these features are fundamental – no banking domain app can do without them. Thereby, any QA Requirements Documentation will have to structure tests around each of these features for comprehensive test coverage.

How to Validate Banking Applications?

Validating a banking mobile app requires thorough testing to ensure that it functions securely, performs well under load, and complies with relevant regulations. Below is a step-by-step guide to help you test banking domain applications.

- Identify testing requirements: Understand the app’s functional, security, and compliance needs, including transactions, data encryption, and regulations like PCI-DSS and GDPR.

- Build test case: Create test cases for all critical areas: functionality, security, performance, compliance, and usability.

- Conduct functional testing: Verify core features like account creation, transaction processing, and error handling.

- Perform security testing: Validate authentication methods, data encryption, session management, and check for vulnerabilities.

- Execute performance testing: Test the app’s ability to handle high transaction volumes and measure response times under load.

- Perform compatibility testing: Ensure the app works across various browsers, devices, and operating systems.

- Conduct user acceptance testing: Verify that the app meets business requirements, performs as expected in real-world scenarios, and satisfies end users’ needs and expectations.

- Perform recovery testing: Simulate crashes and verify smooth recovery without data loss or corruption.

- Conduct usability testing: Evaluate how easily users can navigate the app, complete tasks, and understand error messages.

- Execute integration testing: Ensure seamless integration with third-party services and the core banking system.

- Conduct regression testing: Re-test previously working features after updates to ensure that new changes haven’t affected existing functionality.

Banking Domain Application Testing: Workflow

Testing applications in the banking domain is critical due to the need for security, accuracy, performance, and compliance. A well-defined workflow ensures that all key aspects, functional, regulatory, and technical, are validated thoroughly.

1. Requirement Analysis

Understand business requirements, regulatory constraints (KYC, AML, PCI-DSS), and system workflows such as account management, transactions, and loan processing.

2. Test Planning

Define testing scope, select testing types (functional, security, integration, etc.), identify resources, set timelines, and determine required tools and environments.

3. Test Case Design

Create detailed test cases covering functional scenarios, edge cases, negative paths, and compliance rules. Map test cases to requirements for traceability.

4. Test Environment Setup

Prepare a secure and realistic testing environment that mimics production. Configure integrations (e.g., payment gateways, databases) and load anonymized or synthetic test data.

5. Test Execution

Run manual and/or automated test cases. Validate actual vs. expected outcomes. Log any defects found and prioritize them based on severity and impact.

6. Regression and Retesting

Re-execute failed test cases after fixes. Run regression tests to ensure new code changes haven’t broken existing functionality.

7. Security and Compliance Testing

Perform vulnerability scanning, authentication/authorization testing, and ensure the system meets industry compliance standards like PCI-DSS and SOX.

8. Performance Testing

Assess system performance under varying loads. Perform load, stress, and endurance tests to validate speed, stability, and responsiveness during high usage.

9. User Acceptance Testing (UAT)

With usability testing, business users validate whether the application meets real-world banking workflows and business expectations. Focus is on usability and accuracy of functionality.

10. Test Closure

Summarize testing activities, close out defects, archive artifacts, and update documentation. Conduct a lessons learned session and prepare a test summary report.

Read More: Understanding Test Closure Report

Sample test case for mobile banking applications

There are many test cases for banking applications. Below are some sample test cases:

Test Case for creation of new customer account

Below are the steps for testing creation of new customer account:

- Create a new account with data. Use invalid data to check that it is rejecting the action in this event.

- Check that all authentication requirements are activated.

- Verify that the new data is saved and that it can be updated as required.

- Verify that everyday user actions are working as expected – depositing money, withdrawing money, and that account balance is reflected accordingly.

- Verify that the account provides services aligning with its nature – saving, current, salary, joint, etc.

- Verify that users can maintain zero balance (if it is a salary account) or the minimum balance (if it is not) in the account.

- Verify that users can get relevant notifications – credit/debit of exact amounts, alerts about low balance, warnings about upcoming deductions, etc.

- Verify that the user can safely log out.

Test Case for Service Requests

Below are the steps for testing service requests feature:

- Ensure users can access the service request section from the main menu or dashboard.

- Test key service requests (e.g., account statements, fund transfers, card management).

- Verify proper input validation for service request forms and error handling.

- Confirm users receive email confirmations for submitted requests.

- Test service request tracking (e.g., pending, in-progress, completed).

- Ensure users can cancel pending requests before processing.

- Check for clear error messages on submission failures.

- Verify options for card-related requests, including statements, new applications, and blocking.

Test Case for Money Transfer

Below are the steps for testing money transfer:

- Confirm users can access money transfer options via the main menu or dashboard.

- Test recipient selection from the beneficiary list and validate recipient details.

- Verify transfer amounts meet account balance and transaction limits.

- Test multiple payment methods (e.g., NEFT, RTGS, IMPS) for accuracy.

- Check PIN or OTP verification before completing transfers.

- Ensure accurate recording of transactions in the history section.

- Enforce transaction limits and communicate them clearly to users.

Test Case for New Branch Management

Below are the steps for New branch:

- Confirm authorized users can access the branch management section.

- Verify branch creation forms include fields like name, address, and contact details.

- Ensure unique branch codes or identifiers are assigned.

- Test the ability to assign branch managers during branch creation.

- Check branch type selection options (e.g., main, regional).

Challenges in Banking Domain Testing

Below are some common challenges when it comes to testing in the banking domain:

- Ensuring Secure Transactions: Protecting customer data and transactions from theft and hackers is critical. Testers must implement robust security testing with multiple security layers.

- Data Migration During Branch Shifts: When transferring large datasets and testing new branch functionalities, testers should perform thorough data migration and regression testing to ensure seamless functionality.

- Managing Large Databases: Large banking databases require accuracy and security during upgrades and transactions. Testers must conduct comprehensive database testing using automation tools to validate data flow.

- Multi-Device Synchronization: Synchronizing banking services across mobile, net banking, and physical branches is essential. Testers must conduct compatibility and performance testing to ensure uninterrupted services on all devices.

- Incomplete Documentation: The lack of complete application requirements can hinder testing. Testers should actively participate in requirement gathering and acquire domain knowledge early in the process.

Best Practices for Bank Application Testing

For effective banking app testing, a focus on security, performance, compliance, and reliability is essential. These best practices ensure thorough validation and secure, seamless user experiences.

- In-Depth Requirement Analysis: Understand both functional and regulatory requirements (e.g., PCI-DSS, GDPR). Break down complex workflows, like money transfers or loan processing, to ensure full test coverage.

- Develop Detailed Test Cases: Create test cases covering functional workflows, edge cases, error handling, and regulatory compliance. Test scenarios should include data consistency, transaction rollback, and user authentication.

- Thorough Security Testing: Test for vulnerabilities like SQL injection, cross-site scripting (XSS), and CSRF. Validate multi-factor authentication (MFA), session timeouts, secure encryption, and role-based access controls to ensure data is protected.

- Performance & Load Testing: Simulate high transaction volumes during peak times to test system scalability. Measure response times, transaction throughput, and system stability under stress. Conduct endurance tests to verify app reliability over long usage periods.

- Rigorous Integration Testing: Verify seamless integration with core banking systems, payment gateways, third-party APIs, and transaction processing systems. Check for data synchronization and error-handling during integration points.

- Cross-Platform Compatibility: Test across all platforms (iOS, Android, Web), ensuring the app functions consistently on different devices, browsers, and operating systems. Verify UI responsiveness and ensure smooth user interactions regardless of platform.

- Usability & Accessibility: Test the intuitiveness of workflows, ease of navigation, and accessibility compliance (WCAG). Validate user interfaces for clarity, error messages, and overall user satisfaction.

- Recovery & Backup Testing: Simulate system crashes, network failures, and database corruptions. Ensure backup and disaster recovery procedures are robust and data is fully recoverable without loss.

Test Banking Apps Securely with BrowserStack’s Private Device Cloud

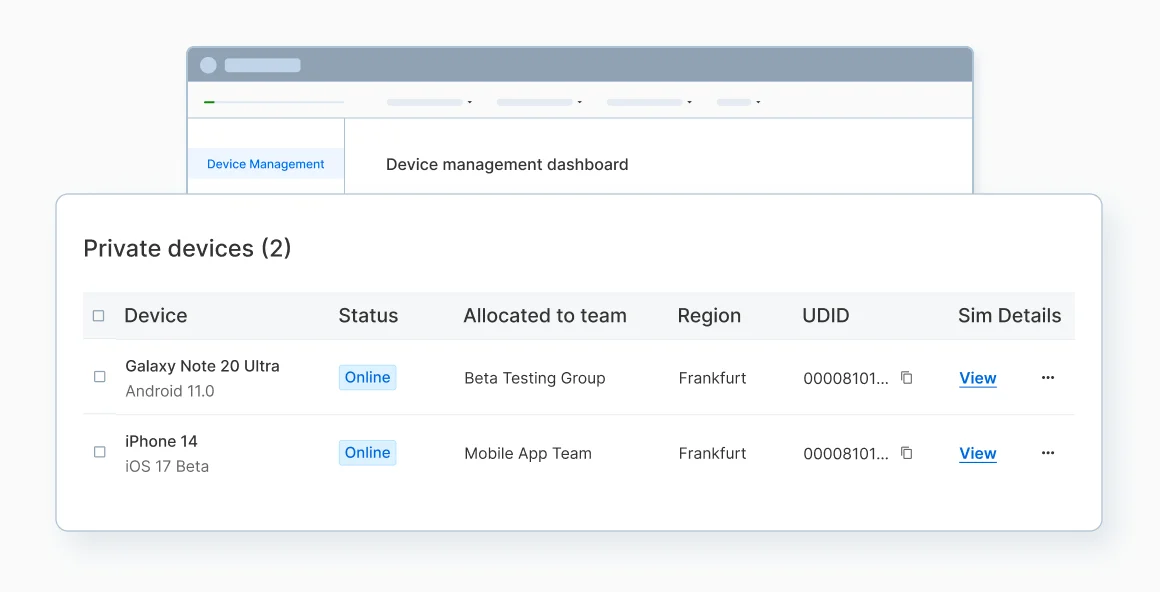

BrowserStack is an all-in-one testing platform designed to help enterprises deliver secure and reliable digital experiences. For the banking domain, where compliance and data protection are critical, BrowserStack’s Private Device Cloud provides a dedicated and high-performance environment to run tests with complete control.

Unlike shared environments, teams get isolated device access, ensuring compliance with financial regulations while retaining the flexibility to configure devices to match real-world conditions. The option to disable device-level cleanup enables app persistence testing and data retention between sessions, streamlining workflows without compromising security.

Here are the key features of BrowserStack Private Device Cloud for testing banking domain applications:

- Custom MDM Support: Manage private devices with your organization’s own MDM solutions.

- App Persistence Testing: Validate that user sessions, preferences, and data are retained across multiple launches.

- SIM-Based Testing: Test banking apps across different SIM cards, regions, and network conditions.

- Wi-Fi and Offline Mode: Simulate connectivity scenarios or test in complete isolation when required.

- Automation Frameworks: Integrate with Appium, Espresso, XCUITest, and more for seamless automated testing.

- In-Depth Insights: Access logs, performance data, and crash reports for faster debugging.

- CI/CD Integration: Connect easily to CI/CD pipelines to automate testing and deployment.

- Device-Level Cleanup Control: Retain or wipe device data depending on your compliance and workflow needs.

- Exclusive Device Access: Get priority access to catalog, non-catalog, or custom devices tailored to banking use cases.

- Enterprise Support: Dedicated Customer Engineers ensure quick resolution of technical challenges.

Emerging Trends in Banking Application Testing

The BFSI sector is entering a new era where customer expectations, security demands, and regulatory shifts are converging. To stay ahead, testing strategies must evolve with the technologies that are transforming banking. Here are the trends shaping the future of application testing in this domain:

1. RegTech-Driven Compliance Automation

Keeping pace with regulatory changes is one of the biggest challenges in banking. RegTech solutions can continuously monitor global regulatory updates, identify their impact on banking applications, and integrate compliance checks directly into testing workflows. This reduces reliance on manual monitoring and ensures faster alignment with evolving standards.

2. Quantum Computing for Advanced Risk Testing

As quantum computing matures, its ability to process data at unprecedented speeds will revolutionize how banks approach stress testing and risk modeling. Testing teams will be able to simulate complex financial systems, uncover vulnerabilities earlier, and deliver applications that can withstand extreme real-world scenarios.

Read More: Risk Based Testing Approach for Agile Teams

3. Biometric Authentication Testing at Scale

With banking apps increasingly relying on biometrics such as fingerprints and facial scans, testing must account for both convenience and security. Future testing frameworks will need to simulate spoofing attempts, validate system robustness against fraud, and certify compliance with biometric security guidelines.

4. Zero-Knowledge Proofs for Privacy Assurance

Zero-Knowledge Proofs are set to transform how sensitive data is verified. In the context of testing, they make it possible to confirm transactions or user credentials without revealing underlying data. This not only strengthens privacy but also helps meet stringent data protection requirements in the financial sector.

5. AI-Powered Predictive Testing

Artificial intelligence is moving beyond automation into predictive insights. By analyzing historical defects, user behavior, and performance data, AI-driven testing tools can forecast where failures are most likely to occur. For banking applications, this means proactively addressing weak points before they become security threats or customer-facing issues.

Read More: AI Automation and Testing

Conclusion

In the banking sector, where every transaction must be secure and every user journey seamless, testing cannot rely on assumptions or limited device sets. Applications must be validated across various real devices, diverse network conditions, and multiple operating systems to ensure compliance and reliability.

BrowserStack allows QA teams to achieve this with scale and precision. With access to 3,500+ real devices and browsers, combined with the control and security of the Private Device Cloud, teams can replicate real-world conditions, identify risks early, and deliver banking apps that meet both customer expectations and regulatory standards.